The “Tax Cuts and Jobs Act” was passed into law before just about everyone went home for the holidays last month. [1]

In some newsrooms, that provided fodder for stories on what the more informed and pro-active among us might and would be trying to do to maximize personal advantage. Other fronts saw a battle of political press releases. [2,3]

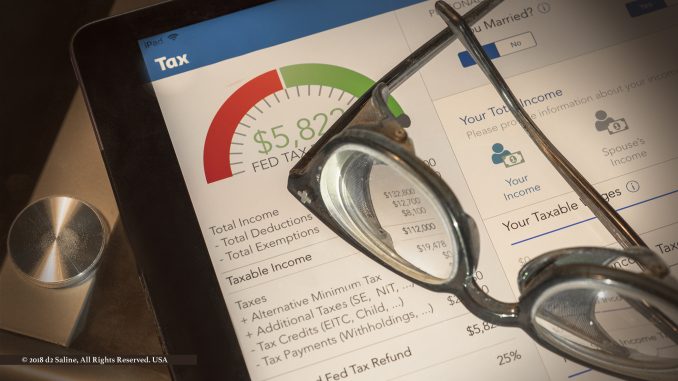

But what does “tax reform” mean to you, personally? And when should you start thinking about a 2018 tax return that won’t be due for another fifteen months?

For starters, describing this Act as “historic” or “comprehensive” tax reform is no overstatement — regardless of whether you are for or against it. “Some of these changes are once in a lifetime,” observes Gabriel Sandler, Financial Adviser and Enrolled Agent with Capstone Tax & Financial in Saline. [4,5]

One of the earliest summaries that he saw on this was over fifty pages in length.

The second thing he notes is that the IRS itself is still in the very earliest stages of implementation. Much like civil legal systems, “tax courts rule on questions as they come up,” Mr Sandler continues. “The IRS puts out these rulings all the time.” Think things were up until passage of the new Act? The IRS was “putting out new rulings for 2017” through the end of that year.

In Saline, Capstone is already seeing two types of clients affected: People who have children and individuals who have pass-through income.

According to national political affairs expert Andy Friedman, doubling here of the standard deduction comes with concern that “the Act will adversely affect real estate values.” He has written in particular about changes to state and local tax deductions, mortgage interest, charitable contributions, and medical expenses. [6]

“The more you have on Schedule A in general, the more you are likely to have some sacrifices,” says Gabriel Sandler. [7]

Additionally, although we’re now clearly into the new year, there are still some tax matters allocations that can be made for last year versus this. IRA and HSA accounts can be funded for 2017 up until April 15, 2018.

Much as the new Tax Cuts and Jobs Act is in flux, Mr Sandler characterizes taking a wait-and-see approach even now — in January — as more than simply imprudent. It’s a real “missed opportunity.”

Whether it’s Capstone, H&R Block, or some other professional tax preparation firm listed by the Saline Area Chamber of Commerce, going through the process with an expert when filing by the April 2018 deadline for the 2017 tax year will actually create the dialogue you need to stay in front of things each step of the way for April 15, 2019. [8,9]

As reported here on the Saline Journal last September, the time to think about tax preparation is always now. [10]

The new Act has made it more so.

References

- “Tax Cuts and Jobs Act” US House of Representatives, Committee on Ways and Means.

- “Metro Detroit communities see rush to prepay 2018 property taxes” Chad Livengood (December 28, 2017) Crain’s Detroit Business.

- “Tax Cut Bill: Bigger Paychecks for Middle Class or Risky Giveaway for Wealthy?” Tran Longmoore (December 20, 2017) The Saline Post.

- “What is an Enrolled Agent?” National Association of Enrolled Agents (NAEA).

- Capstone Tax & Financial (home page).

- “Tax Reform Accomplished: How Does the Legislation Affect Investors and Businesses?” The Washington Update from Andy Friedman.

- “About Schedule A (Form 1040), Itemized Deductions” Internal Revenue Service (IRS).

- H&R Block (Saline office).

- “Category: Accounting > Tax Preparation / Audits” Saline Area Chamber of Commerce.

- “There’s No Reason to be Surprised by Your Taxes” Dell Deaton (September 25, 2017) Saline Journal.